Blogs

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by third party sources that Future Benefits Insurance & Retirement Planning, deems reliable but in no way does Future Benefits Insurance & Retirement Planning guarantee its accuracy or completeness. Future Benefits Insurance & Retirement Planning had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Future Benefits Insurance & Retirement Planning. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Future Benefits Insurance & Retirement Planning, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Fixed Index Annuity

What Is a Fixed Index Annuity? A fixed index annuity is a financial product whose terms are defined by a contract between you and an insurance company. It features...

Why Annuities May Be a Safer Bet in 2025

Many people decide to claim their Social Security benefit when they retire. You may be one of them. It could be that you need the money, or maybe you want to invest it...

Annuity Awareness Month 2025: Your Guide to Income Security

Each June, Annuity Awareness Month shines a spotlight on one of retirement’s most misunderstood—but potentially powerful—financial tools: the annuity. In 2025, as...

6 Ways to Secure Your Finances After Retirement

Although your CalPERS service retirement is a lifetime benefit, and you have other income sources available to you, money can still be tight. Making ends meet is a big...

Retirement planning with annuities in 2025: Key considerations and trends

Annuities have seen a resurgence in popularity as a retirement planning tool, especially in 2025, driven by market volatility, higher interest rates, and an aging...

7 steps to prepare for your upcoming retirement

Planning to retire within the next 10 years? Taking these actions now could help bolster your portfolio as you approach your planned retirement date. After decades of...

Getting Ready for Retirement Checklist

If the word “retire” is becoming your new mantra, we suggest you make a retirement checklist before you receive your last paycheck. It’s never too early (or too late)...

The Most Important Ages of Retirement

Retirement is a series of milestones that arrive as you age. Here are the ones you should know about. The retirement clock doesn't start the day you stop working. It's...

Social Security Benefits Changes in 2025: What You Need to Know for Smarter Retirement and Tax Planning

Social Security is one of the most essential yet misunderstood pieces of the American retirement puzzle. With all the recent headlines, ranging from benefit increases...

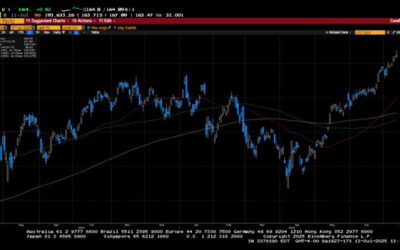

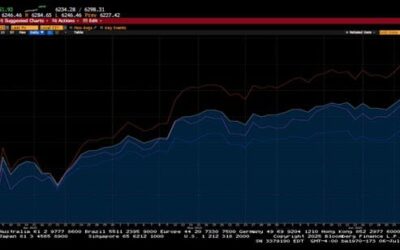

Weekly Market Commentary

Investors sent the S&P 500 to another all-time high in a holiday-shortened week of trading. President Trump started the week by asking the Supreme Court to...

Weekly Market Commentary

The S&P 500 posted a gain for the fourth consecutive month as investors continued to embrace the prospects of a September rate cut, a robust economic outlook, and...

Weekly Market Commentary

Global financial markets had another positive week as the Dow Jones Industrial Average finally joined the S&P 500 and the NASDAQ with a new all-time high. Benign...

Weekly Market Commentary

Global financial markets rallied last week as investors stepped in again to buy the prior week’s dip in prices. Japan, Germany, Spain, and Italy were international...

Weekly Market Commentary

Markets forged another set of all-time highs before taking a step back last week as a deluge of information had to be digested by investors. August 1st was the tariff...

Weekly Market Commentary

The S&P 500 and NASDAQ reached another set of all-time highs, driven by constructive rhetoric on global trade and positive second-quarter earnings results from...

Weekly Market Commentary

U.S. equity markets were little changed for the week; that said, the S&P 500 and NASDAQ were able to forge another set of all-time highs. A busy Q2 earnings...

Weekly Market Commentary

A barrage of tariff letters sent to over 20 countries by President Trump yielded very little movement in the financial markets. Trump announced that there would not be...

Weekly Market Commentary

The holiday-shortened week produced another week of gains for US equity indices. The S&P 500 was up 10.6 % in the 2nd quarter, while the NASDAQ composite rose...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Future Benefits) or (Future Benefits Insurance & Retirement Planning) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Future Benefits Insurance & Retirement Planning.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

The “Still-Working Exception” and December 31 Retirement

By Ian Berger, JD IRA Analyst As the end of the year approaches, you may have plans to retire on December 31. However, if you are using the “still-working exception” to...

2025 Year-End Retirement Account Deadlines

By Sarah Brenner, JD Director of Retirement Education The end of the year always brings a flurry of retirement account deadlines and planning opportunities. This...

Qualified Distributions and Successor Beneficiaries: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Dear IRA Help, Here is my specific case. I am 84 years old. I opened a Roth IRA on March 30,...

Do QCDs Actually Reduce AGI?

By Andy Ives, CFP®, AIF® IRA Analyst It has come to our attention that confusion exists as to how qualified charitable distributions (QCDs) impact one’s taxes....

Trump Accounts and the Pro-Rata Rule: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: We have two grandchildren. One is 18 years old now, and the other will turn 18 next January (2026). Can you help me...

Avoiding the 10% Early Distribution Penalty for Certain Hardship Withdrawals

By Ian Berger, JD IRA Analyst Most 401(k) plans (as well as 403(b) and 457(b) plans) offer hardship withdrawals while you are still employed. If the withdrawal comes...

The Once-Per-Year Rollover Rule and SEP IRA Contributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: I recently retired in January and rolled over a lump sum pension from my previous employer into my IRA....

The Craziest Stuff I’ve Heard

By Andy Ives, CFP®, AIF® IRA Analyst The Ed Slott team has answered literally tens of thousands of IRA and retirement plan questions over the past few years. That is...

In ERISA Retirement Plans, Spouse Beneficiaries Rule

By Ian Berger, JD IRA Analyst At Ed Slott and Company, we continually stress how important the beneficiary designation form is. Because it’s that form – and not...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Future Benefits Insurance & Retirement Planning, deems reliable but in no way does Future Benefits Insurance & Retirement Planning guarantee its accuracy or completeness. Future Benefits Insurance & Retirement Planning had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Future Benefits Insurance & Retirement Planning. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Future Benefits Insurance & Retirement Planning, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Six Changes Coming to Social Security in 2026

Big changes are coming to Social Security in the year ahead, impacting everything from the size of your benefit check to your full retirement age. Here's what you need to know. In January 2026, several changes to Social Security will take effect, impacting everything...

Vaccines Medicare Covers for Free in 2025

The U.S. is experiencing an outbreak of measles and is on track to have the most whooping cough cases since 1948. These vaccines Medicare covers for free can keep you safe. Did you know that Medicare fully covers many vaccines for its beneficiaries? Well, they do....

Navigating Medicare Changes in 2025 for People Living with ALS: A Comprehensive Guide

Living with ALS presents a unique set of challenges, especially when it comes to managing your health care needs and medications. In 2025, important changes are coming to Medicare that could significantly impact how you access prescription drugs and manage your...

Colorectal cancer screenings can save your life

Get a colorectal cancer screening at no extra cost to you. Learn more about life-saving screening options. Have you been putting off your colorectal cancer screening? It may not be the top of your to-do list, but regular screening tests can save lives. Colorectal...

Get the care you need quickly when you’re sick

Discover six ways to access care fast, even if your doctor is busy. Hint: You may not need to go in person. Doctors’ offices are busier than ever these days. Sometimes it can be tough to book a timely appointment with your primary care provider. You might be sick or...

Can You Apply for Medicare Without Social Security?

Key Points You do not need to be receiving Social Security benefits to apply for Medicare. You can receive Social Security benefits as early as 62 and Medicare benefits at 65. If you are already receiving Social Security benefits before your 65th birthday, you’ll be...

Is the Medicare Annual Wellness Visit Mandatory?

Key Points While the Medicare Annual Wellness Visit is not mandatory, it is a 100% covered preventive service. The Annual Wellness Visit differs from the typical annual physicals you were used to with group coverage. If you’ve had Medicare Part B for more than 12...

Why You Need Part D

Key Points Medicare Part D is a voluntary program, but if you do not enroll in a plan, you won’t have coverage for expensive medications. You will also have a late enrollment penalty if you don’t have other creditable coverage. Medicare Part D is a huge time...

Medigaps

Original Medicare Part B covers 80% of the cost of most services. But what about the other 20%? Or the other out-of-pocket costs like deductibles or inpatient copays? Let’s discuss Medigaps, which can help cover these costs. What are Medigaps? Medigaps are health...

Financial Services

Insurance Services

Educational Blogs

Medicare

Future Benefits Insurance & Retirement Planning Location

Memphis, Tennessee

3238 Players Club Circle

Memphis, TN 38125

Contact Us: (901) 754-2040

futurebenefits@gmail.com